PDIP 19 - Changes to the Tokenomics of $PDT

Authored by DeFi Ted and Milamber.

Summary

This proposal aims to bolster the backing of the $PDT token by resolving community concerns over treasury support of the underlying redeemable value. It outlines a dual approach to ensure $PDT backing, refine the backing valuation calculations, secure ongoing development funding, and revise the distribution of fee shares to stakeholders.

Abstract

$PDT, the governance token of ParagonsDAO, was introduced through a novel NFT Initial Bond Offering. It features a direct claim on the treasury and earnings from bonded NFTs, with 30% of $PRIME obtained through Echelon interactions allocated to $PDT stakers. The token’s value is secured by the treasury it governs.

Motivation

The proposal addresses community concerns transparently and effectively, ensuring no detriment to any party (“no Peter and Paul scenario”). It focuses on creating sustainable, measurable strategies for managing treasury capital and distributing earnings equitably among stakeholders.

Specification

The proposal introduces a clear bifurcation of fee categories for more effective distribution:

Yield: Generated from treasury assets in trading or yield strategies. This includes liquidity positions in PRIME and ETH.

Rewards: Arising from protocol interactions, such as gaming events in Parallel.

Yield Distribution

- Reinvested into Strategy: 37.5%

- Buy Back and Burn: 37.5%

- Treasury for Development Funding: 25%

A weekly buyback and burn strategy will provide regular liquidity for the PDT/ETH pair, enhancing market stability.

Rewards Distribution

- Staking Pool: 90%

- Treasury Hard Cap: 10%

This proposal excludes redemptions initially, suggesting a 12-month trial of the new tokenomics before considering further changes. The Treasury Council will oversee the adjustment of these percentages through a Treasury PCCP vote.

Rationale

To establish a clear backing value per $PDT, we first identify the circulating supply:

- Total PDT: 162,500,000

- PDT in Treasury: 25,317,737

- Total Circulating: 137,182,263

All vesting tokens in solv.finance vesting have expired and are considered available and on the market, these were vouchers given to founders and early contributors. All remaining PDT yet to be released to the market remain in the Treasury today.

Treasury Totals.

| Current Treasury Liquid Assets | |||

|---|---|---|---|

| Name of Token | Token Amount | Price per Token | Total |

| Magpie XYZ (ETH) | 10 | $3,094.40 | $30,944 |

| Renzo (ETH) | 10 | $3,094.40 | $30,944 |

| Eigenlayer (ETH) | 20 | $3,094.40 | $61,888 |

| Etherfi (ETH) | 20 | $3,094.40 | $61,888 |

| KelpDAO (ETH) | 20 | $3,094.40 | $61,888 |

| ETH | 633.573 | $3,094.40 | $1,960,528 |

| PRIME/ETH LP 2 (PRIME) | 0 | $19.26 | $0 |

| PRIME/ETH LP 1 (PRIME) | 72,366.00 | $19.26 | $1,393,769 |

| USDC | 1114000 | $1.00 | $1,114,000 |

| PDT/ETH LP (ETH) | 268 | $3,094.40 | $829,299 |

| PRIME/ETH LP 2 (ETH) | 0 | $3,094.40 | $0 |

| PRIME/ETH LP 1 (ETH) | 275 | $3,094.40 | $850,960 |

| stETH | 1035 | $3,094.40 | $3,202,704 |

| PRIME | 453177 | $19.26 | $8,728,189 |

| Aero LP PRIME | 48,044.00 | $19.26 | $925,327 |

| Aero LP ETH | 296 | $3,094.40 | $915,942 |

| AERO | 24,505.00 | $1.1000 | $26,956 |

| SAFE | 21,484.99 | 1.82 | $39,103 |

| PDT/ETH LP (PDT) | 6933148 | $0.1200 | $831,978 |

| Total Liquid Treasury | $20,234,330 | ||

| Current Treasury Illiquid Assets | |||

| Parallel NFTs | $4,028,622 | ||

| Parallel Masterpieces | $1,004,563 | ||

| Parallel Avatars | $312,568 | ||

| ARBO NFTs | $30,000 | ||

| The Watch NFTs | $71,000 | ||

| Other NFTs | $40,000 | ||

| Total NFTs in Treasury | $5,486,753 | ||

| Total Treasury | $25,721,083 |

*PDT is not accounted for in totals

| Backing Totals | |

|---|---|

| Total Supply | 162,500,000 |

| Treasury held PDT | 25,317,737 |

| Current Circ Supply | 137,182,263 |

| Total Staking Pool | 94,699,323 |

| Market Cap at current PDT Price of Circ Supply | $16,461,872 |

| Current Price PDT | $0.1200 |

| Hard Cap Treasury | $20,377,393 |

| Hard Cap $PDT | $0.148542 |

| Soft Cap Treasury | $25,864,146 |

| Soft Cap $PDT | $0.18854 |

| Current Discount to Hard Cap | 19.22% |

| Current Discount to Soft Cap | 36.35% |

Backing Structure

To ensure confidence in $PDT’s price backing, we assume that the token can be redeemed, recognizing that the redemption value will involve trade-offs due to the illiquidity of certain treasury assets. Under this model, if a holder burns $PDT for their share of the liquid treasury, any NFTs would be discounted or forfeited to other holders.

To clarify valuation moving forward, we introduce two distinct caps:

Hard Cap: Reflects only the liquid treasury assets, setting a per-$PDT value as above.

Soft Cap: Incorporates both liquid and illiquid assets for a per-$PDT value as above.

These caps ensure transparency and provide a framework for accurately understanding $PDT’s backing structure in different scenarios

Current Yield Strategies

- Aerodrome PRIME/ETH:

The DAO has strategically collaborated with Aerodrome to establish the first PRIME/WETH liquidity pool. By offering voter incentives, they attract more AERO rewards, which are reinvested into the pool. This enhances liquidity, maintains incentive recoupment, and increases LP share. Initially, PRIME incentives were reduced to minimize dilution, but the DAO intends to raise incentives once PRIME staking for PROMPT is active, maximizing returns through increased liquidity share.

- UniV3 PRIME/ETH:

As a major liquidity provider on Ethereum, the DAO earns daily fees ranging from $3,000 to $10,000 depending on LP size. This fee generation is supplemented by strategic monthly rebalancing of PRIME holdings to maintain a balanced treasury. Although some liquidity has shifted to Aerodrome for improved yield, the remaining $1.6 million in Uniswap still produces significant returns. The range-bound strategy ensures steady revenue, while a buy-sell range protects the treasury by optimizing PRIME trading between $11 and $40, based on current ETH pricing.

*The DAO holds the number 3 LP position (702417) relative to all other LPs on Uniswap on Ethereum

- PDT/ETH:

The DAO maintains virtually all liquidity for PDT, which has traditionally seen low trading volume. With the launch of new Parallel bonds and planned CEX listing, the DAO anticipates increased fee revenue. A future PDT/WETH pool on Base will follow a similar strategy as the PRIME/WETH pool on Aerodrome, utilizing the same AERO reward mechanism to deepen liquidity and draw community participation. Partners are consulted for automated strategies to stabilize trading activity.

- stkETH:

The DAO historically staked ETH conservatively via Lido, achieving a 3% base yield. New diversification into protocols like Eigenlayer, Etherfi, and Swell aims to raise this average to 5-6%, while maintaining risk awareness. Over 600 ETH, unlocked from Uniswap adjustments, will be reinvested strategically. A portion of the 1,000 ETH staked with Lido will also be redeployed for broader diversification and increased returns.

These comprehensive strategies collectively align with the new buyback and burn approach, ensuring consistent yield, liquidity stability, and equitable fee distribution for all stakeholders.

Staker Earnings

Stakers will continue earning $PRIME and other tokens through airdrops, claims, and player rake returns. Additionally, they will receive future fees generated by ParagonsDAO’s products. Currently, stakers are subsidized by 30% of $PRIME from caching events according to existing tokenomics.

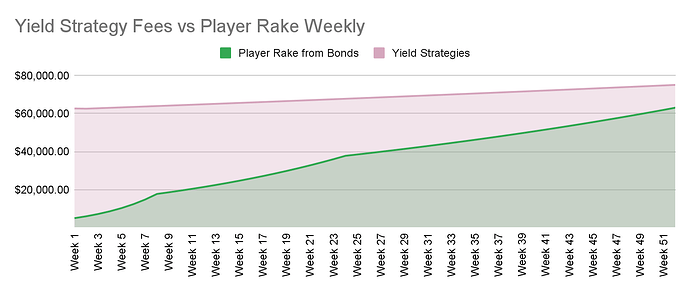

Recently, the Treasury Council temporarily increased this subsidy to cover the last two months. The proposed charts align with anticipated player returns in the staking pool, factoring in reduced reliance on the subsidized $PRIME supply.

New tokenomics if accepted via vote can be implemented immediately, we have currently explored options with Aera.Finance which is a product built by Gauntlet to better manage our Uni V3 positions. The Treasury will explore further automations of the strategies and disbursements.

Copyright Waiver

Copyright and related rights waived via CC0.